8 Easy Facts About Estate Planning Attorney Explained

Table of ContentsAbout Estate Planning AttorneyWhat Does Estate Planning Attorney Mean?An Unbiased View of Estate Planning Attorney

The various costs and costs for an estate strategy need to be reviewed with your attorney. There are many sources for estate planning offered on the net or by different companies, and the incentive to stay clear of attorneys' costs is often a motivating variable.

It is additionally feasible that it will be transformed as an outcome of the change of management in 2020. The Illinois estate tax obligation limit quantity is $4,000,000 and an estate with also $1 over that quantity goes through tax obligation on the entire quantity. An individual whose estate goes beyond these exception or threshold degrees requires to do some added estate preparing to reduce or get rid of fatality taxes.

The Illinois estate tax threshold is not portable. Typically, a present of building from a person to his or her partner that is a united state person is not subject to a present tax obligation or an inheritance tax. Gifts to anyone else is a taxable present, but goes through an annual exemption (discussed below) and the very same life time exception when it comes to federal inheritance tax.

Our Estate Planning Attorney Ideas

Some estate strategies might include lifetime gifts. In 2020, a person can surrender to $15,000 a year to anyone without a present tax obligation. In addition, under certain circumstances, an individual could make presents for clinical expenses and tuition costs over the $15,000 a year limit if the clinical payments and tuition payments were made straight to the clinical service provider or the education copyright.

Spouses and partners frequently have residences and financial institution accounts in joint occupancy. It is utilized less regularly with nonspouses for a selection of reasons. Each joint occupant, despite which one acquired or initially owned the building, deserves to make use of the jointly owned property. When two individuals very own residential or commercial property in joint occupancy and one of them passes away, the survivor becomes the 100 percent owner of that home and the dead joint renter's interest ends.

When a tenant-in-common passes away, his or her rate of interest passes to his or her estate and not to the surviving co-tenant. The building passes, instead, as component of the estate to the successors, or the beneficiaries under a will.

Not known Facts About Estate Planning Attorney

Illinois has actually adopted a law that enables monetary accounts, such as with a brokerage firm, to be registered as transfer on fatality ("TOD"). These are similar to a payable on death account. At the death of the proprietor, the visit our website properties in the account article are moved to the marked beneficiary. Illinois has lately taken on a statute that allows certain property to be moved on fatality through a transfer on death instrument.

The recipient of the transfer on fatality tool has no rate of interest in the real estate up until the fatality of the proprietor. All joint occupants must agree to the sale or home loan of the building. Any kind of one joint tenant might withdraw all or a part of the funds in a joint checking account.

Estate, present, or income taxes may be influenced. Joint occupancy might have various other repercussions. : (1) if residential or commercial property of any kind is held in joint tenancy with a family member who obtains welfare or various other benefits (such as social protection benefits) the relative's privilege to these benefits might be endangered; (2) if you put your home in joint occupancy, you might shed your right to advantageous elderly person real estate tax obligation therapy; and (3) if you develop a joint tenancy with a youngster (or any individual else) the kid's financial institutions might seek to gather your youngster's debt from the home or from the proceeds of a judicial sale.

Joint occupancies are not a straightforward option to estate issues but can, in truth, develop click here for more info problems where none existed (Estate Planning Attorney). The expenses of preparing a will, tax preparation, and probate might be of little relevance compared to the unintended problems that can arise from utilizing joint occupancies indiscriminately. For a full description of the benefits and negative aspects of joint tenancy in your particular circumstance, you should seek advice from a legal representative

Tiffany Trump Then & Now!

Tiffany Trump Then & Now! Raquel Welch Then & Now!

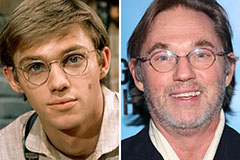

Raquel Welch Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Traci Lords Then & Now!

Traci Lords Then & Now! Tonya Harding Then & Now!

Tonya Harding Then & Now!